Kaitlin Howard is a researcher and writer producing insightful content across the healthcare revenue cycle. She has written and produced content for Zelis, Waystar, and Recondo Technology, as well as agencies. With a B.A. in English and Writing from University of Denver, Kaitlin stays current on market updates on claims management and healthcare payments, publishing a regular educational blog series on industry trends and Zelis offerings.

Our latest Payment Harmonization Benchmark – Payment integrity and cost containment in healthcare – is in. The data shows that healthcare payers continually seek to optimize both operations and financial results. One way to accomplish that goal is through cost containment measures.

Based on a Q1 2022 survey of more than 200 healthcare payer executives, the Payment Harmonization Index was designed to establish the current state of payer engagement with members, identify gaps throughout the member experience, and explore the interdependence among payers, providers, and members.

Findings from the study are presented in a series of five reports.

This report, Payment Integrity and Cost Containment in Healthcare highlights findings from payment accuracy executives to offer an outline for the next wave of payment integrity and cost containment.

More specifically, this report assesses how payment integrity and cost containment professionals across the U.S. apply data, analytics, and automation in their processes to address their biggest gaps and opportunities. Furthermore, it highlights the tools, functionality, and services payers can leverage as part of their future strategic cost containment efforts.

We’ll discuss some key insights below, and you can access the full report here.

The landscape

Healthcare payers are continually seeking to optimize their operations and financial results. Cost containment measures can help. But to do so, payers must focus their strategy on provider reimbursements, ensuring the correct providers are paid for the right members, at the right levels, with the right codes.

Increasing provider satisfaction (both prior to claim submission and after) is key. Payers must focus on relationship building — aligning incentives and increasing communication.

And while most payers now have moderate to strong levels of automation in their payment integrity processes, just how comprehensive their automation is, as well as their level of implementation, varies considerably.

Key findings

The payment integrity benchmark should be used as a point of reference to assess how well your organization enables harmony across the cost containment process. The study yielded a weighted scorecard that considered the following:

- Pre-pay automation

- Post-pay automation

- Reduction of denials

- Reduction of appeals

- Provider abrasion

- Claim adjudication analytics

Payers that had taken more steps that aligned with their priorities for harmonious cost containment resulted in more earned points. In a similar fashion, payers that had fewer actions in place to support process harmony earned fewer points. When aggregated and weighted, all scores ultimately formed an industry index.

In other words, actions that healthcare payment integrity executives took to advance their cost containment programs determined their scores, as well as how they fared when compared to the benchmark.

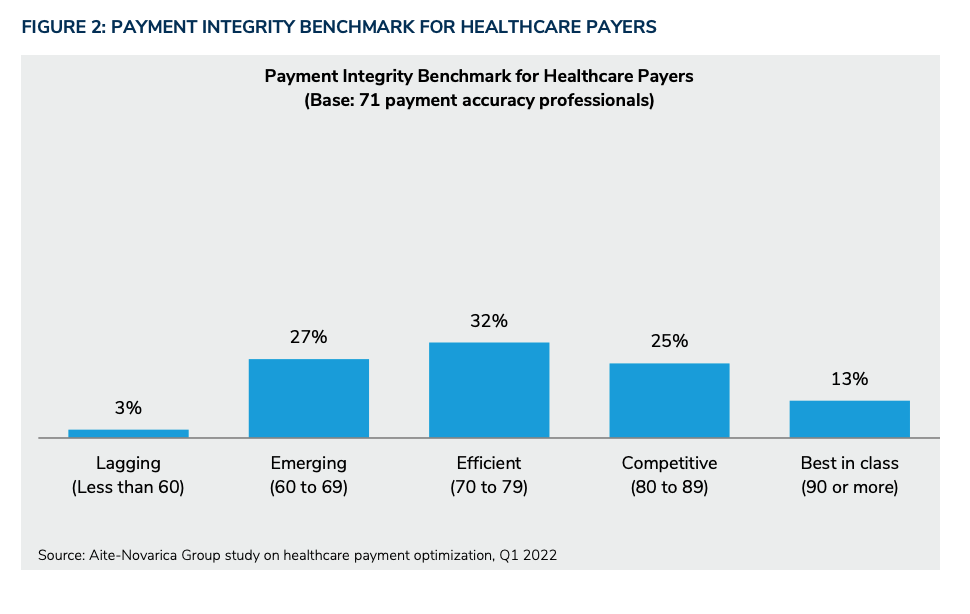

Responses were then ranked in stages labeled as laggard, emerging, efficient, competitive, or best in class.

Harmonious cost containment remains a WIP

Only 13% of respondents showed leadership in implementing harmony-promoting measures. This signifies the “best in class” group.

Thirty percent of payment integrity executives indicated they had only partially carried out actions to enable a harmonious process, which, in turn, placed them in the “laggard” and “emerging” category.

This means that while we truly are beginning to see more and more payers work towards harmonious cost containment, a lot of organizations tend to “talk the talk” rather than “walk the walk.”

Provider abrasion remains a sticking point

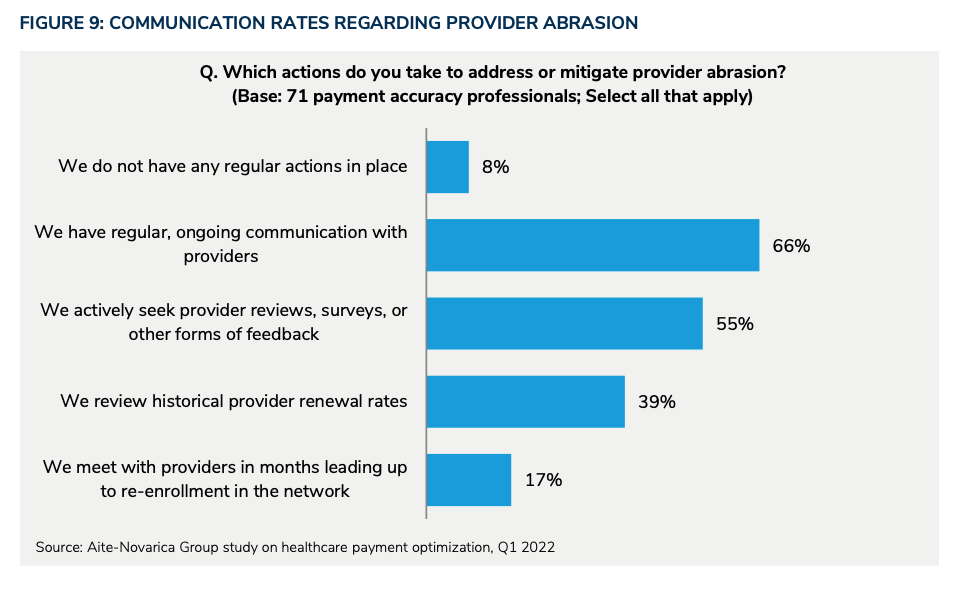

Payers and providers have vastly different perspectives on just how much provider abrasion exists.

From the payer side of things, it seems that providers receive on-going streams of claims they must then review (and later, audit). The issue; however, is that providers are not keeping up with said claims in a timely manner. Some payers even stated that providers are less responsive than ever before, even as an increase in denials looms on the horizon.

Providers lament that payers have become much too strict and, as a result, are unwilling to issue reimbursements.

While vendor partners may bring a level of objectivity to this issue, it truly is up to both payers and providers to increase communication and transparency and reduce provider abrasion.

Best practice

One way to increase transparency and ensure smooth-sailing is to implement a payment integrity solution that extends beyond ensuring claims get paid at the correct rates. Rather, your ideal solution should balance provider abrasion and prevent improper payments.

The shift to pre-pay is on the horizon

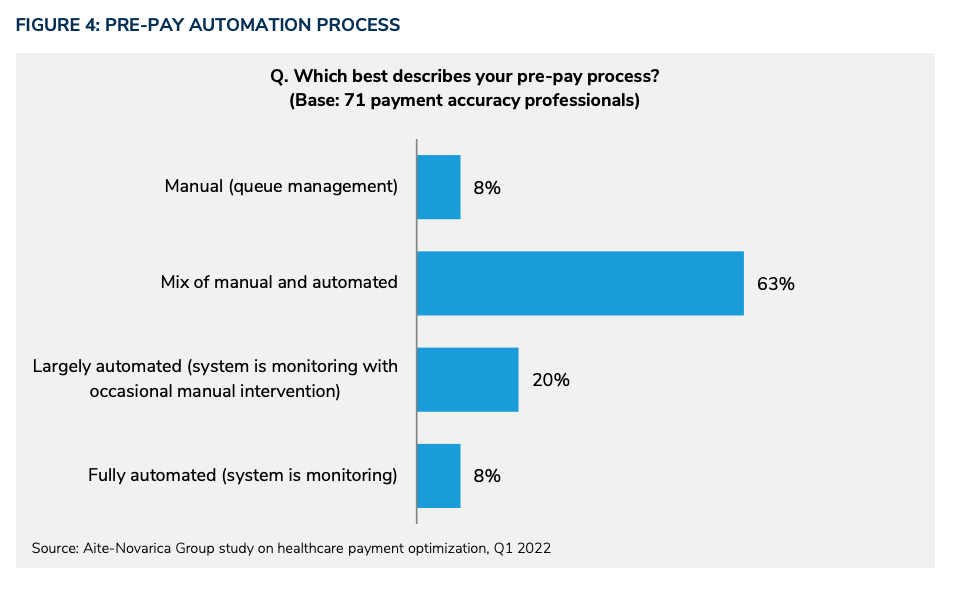

Automating claims adjudication continues to shift toward pre-pay processes, aiming to prevent overpayments altogether.

In an ideal world, all claims would be reviewed for accuracy at the time of submission, and none would require post-pay reviews, audits, or claw-back efforts of past paid claims.

But we’re not there yet.

In fact, 8% of payment accuracy professionals still list their claims process as fully manual.

The goal then, instead, should be to minimize errors that require rework. As such, moving the review of claim payments from after a claim is paid (aka post-pay) to before a claim is paid (aka pre-pay) must become the new industry standard.

We must collectively move away from the traditional pay-and-chase model toward more proactive solutions that focus on engaging with targeted providers sooner and stopping improper payments before they happen.

Best practice

Look for a vendor partner that specializes in pre-pay capabilities and diagnostic-related group (DRG) audits. They can, in turn, help you to better understand reimbursement methods and intervene at the pre-pay phase to validate correct coding.

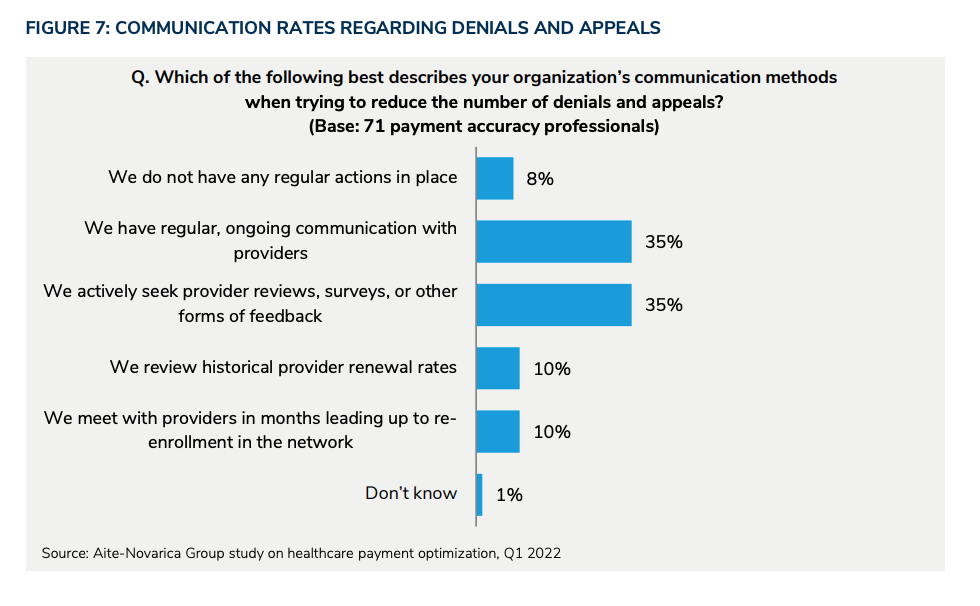

Communication during denials and appeals leaves room for improvement

If you’re looking to reduce appeals and claim denials, communication is essential.

According to the survey, only 35% of payers have regular contact with providers. Eight percent of respondents don’t have any regular provider communications in place.

Minimum requirements for payment integrity solutions include a delicate balancing act of minimizing provider abrasion and preventing improper payments, while also paying claims correctly and in a timely manner.

Best practice

Consider administering a sort of “feedback loop” where the reasoning behind claim denials is communicated directly to providers, along with suggested provider behaviors to conform to claim adjudication requirements and reduce inappropriate billing practices for future submissions.

The path to automated adjudication is long

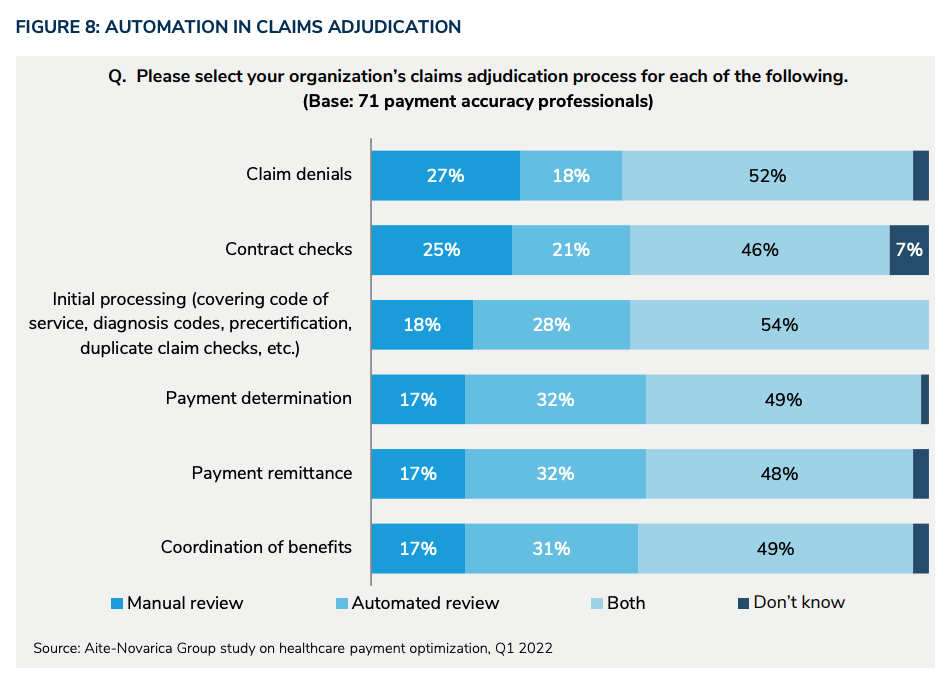

Claims adjudication is at the core of payment integrity.

Automated tools can help, but, currently,only 27% of adjudication review processes are fully automated.

Best practice

Look for a vendor partner that aims to automate as much of the adjudication process as possibly via partner integrations and aligned solutions.

The wrap up

For health plans that grapple with cost containment and preserving their provider networks, increasing focus on provider satisfaction (both prior to claim submissions and after) can be a valuable differentiator. It’s time to focus on relationship building to align incentives and trackable operating metrics.

Interested in reading the whole report to see how payment integrity and cost containment professionals across U.S. address their biggest gaps and opportunities? Dissect the full report here.