In April 2022, when the Centers for Medicare & Medicaid Services (CMS) opened the No Surprises Act’s (NSA) Independent Dispute Resolution (IDR) process for business, some problems immediately became clear.

In planning the IDR process — in which third-party entities would decide on reimbursement for NSA disputes between payers and providers — CMS had vastly underestimated:

- The number of providers that would utilize the IDR, and

- The number of disputes that payers challenged as ineligible for the process.

In fact, over 60% of disputes initiated in the IDR process remained unresolved by mid-2023, according to a December 2023 Government Accountability Office (GAO) analysis.

In this blog, we’re going to talk about CMS’ proposed ideas for fixing the IDR process so it can 1) more efficiently handle the number of disputes coming into the system, and 2) manage the high number of challenges to the eligibility of the disputes.

In previous posts, we highlighted the proposed IDR registry and how the open negotiation period would change should the rules be finalized.

The good news is, since the proposed IDR process rules build off the changes proposed to the open negotiation period, the IDR process itself should be better able to handle large numbers of disputes. This is because most of the required information about a given dispute would be already provided during open negotiations. Further, CMS proposes that a completely new process be set up to manage eligibility challenges on any given dispute.

The bad news: The proposed IDR process has stricter and tighter deadlines for all parties.

For example, according to the proposed rule, the initiating party (typically a provider) must provide a written Notice of IDR Initiation to the non-initiating party (typically a payer) and to CMS through the IDR portal to officially initiate the IDR. The provider must provide this notice within 4 business days after the last day of the open negotiation period.

As I said, many information requirements for the Notice of IDR Initiation are the same or similar to those required to initiate the open negotiation period (indicated by an asterisk in the lists below).

The Notice of IDR Initiation must include:

- Contact information sufficient to identify the provider – includes any third party representing the provider in the dispute.*

- Info identifying the item or services, including:

- Date(s) services were furnished, date of initial payment/denial*

- Type of service, state where the item/service was furnished, claim number and service code, location where the item/service was furnished*

- The initial payment amount and a copy of initial payment/denial*

- A statement that the provider was a nonparticipating provider on the date the item/service was furnished; and

- A statement describing the key aspects of the claim discussed by the parties during open negotiation that relate to the payment for the disputed claim, whether the reasons for initiating the IDR process are different from those aspects discussed during the open negotiation period, and an explanation of why the party is initiating the IDR process.

When a payer receives a Notice of IDR Initiation, it must provide a written notice and supporting documentation in response (i.e., a Notice of IDR Initiation Response) to the provider and to CMS through the IDR portal within 3 business days after the date of IDR initiation.

The IDR Initiation Response must include:

- Contact information to identify the provider – includes any third party representing the payer;*

- The date(s) that the provider received the initial payment or notice of denial;*

- The claim number;*

- A statement as to whether the payer agrees that the initial payment and the Qualifying Payment Amount (QPA) reflected in the Notice of IDR Initiation was the initial payment amount and/or the QPA disclosed with the initial payment or notice of denial, and if not, the initial payment amount and/or QPA it believes to be correct, and documentation to support the statement;

- The amount of cost sharing imposed for the item/service, if any;*

- Several conforming statements/attestations; and

- A final statement as to whether the payer agrees or objects to the provider’s preferred Independent Dispute Resolution Entity (IDRE).

- If the payer does object, the notice must include the name of an alternative preferred IDRE and, if applicable, an explanation of any conflict of interest with the provider’s preferred IDRE.

Following submission of the IDR Initiation Notice and IDR Notice Response through the portal, and once an IDRE is selected to adjudicate the dispute, the proposed rule requires that the selected IDRE review the information in the Notice of IDR Initiation/Response and any additional information.

The IDRE then makes a final determination as to whether the item/service in question does, in fact, qualify as eligible for the IDR process. The IDRE must make this eligibility determination and notify CMS and both parties no later than 5 business days after the IDRE’s final selection.

The proposed rule also allows CMS to step in and handle eligibility determinations during times of high volume or other extenuating circumstances.

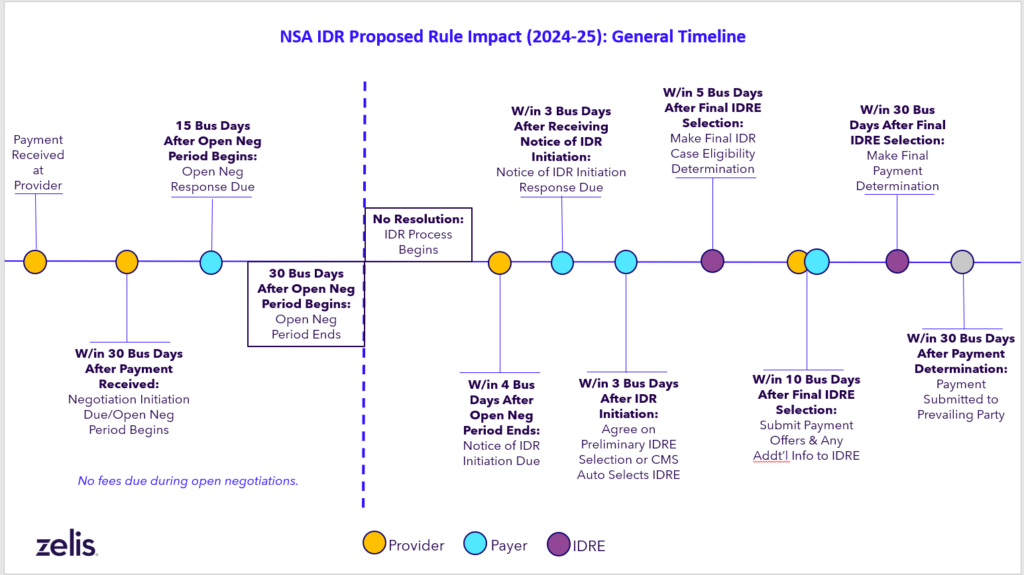

Admittedly, that was a lot of material we just shared, so let’s break things down into an illustration. Here’s a quick refresher on the IDR process timeline if/when the proposed rule becomes final:

In its proposed rule, CMS envisions the NSA portal to be a central location where all negotiations and IDR disputes can be tracked and where all the information about the parties, the claims, and the nature of the disputes are transmitted and stored.

If CMS is successful at digitalizing the portal as proposed, the government would certainly be better equipped to manage the large numbers of users of the process and the large number of eligibility challenges.

In order to completely solve those two issues, however, plans, providers and the IDREs would have to be able to meet the tight deadlines and gather the large amounts of information proposed by CMS in its rule.

All of this is a tall order for all parties involved.

To keep learning more about the proposed changes, read our blogs about a new health plan registry, the open negotiation period and new timelines for IDR fees.