Let’s talk through the fees associated with the IDR process and the timeframes in which they should be paid.

To start, there are two types of fees that are collected from both payers and providers for their participation in the IDR process:

- The administrative fee: A fee that ostensibly covers the Centers for Medicare & Medicaid Services’ (CMS’) costs for administration of the IDR process; and

- The Independent Dispute Resolution Entity (IDRE) fee, which goes to the IDREs for their dispute resolution services.

IDREs will no longer collect these two types of fees as they do now. Both the administrative fee and IDRE fee will be collected by CMS, per CMS’ proposed rule. Additionally, CMS clarified that both types of fees will be established annually via rulemaking, rather than in guidance, so they are subject to change year by year.

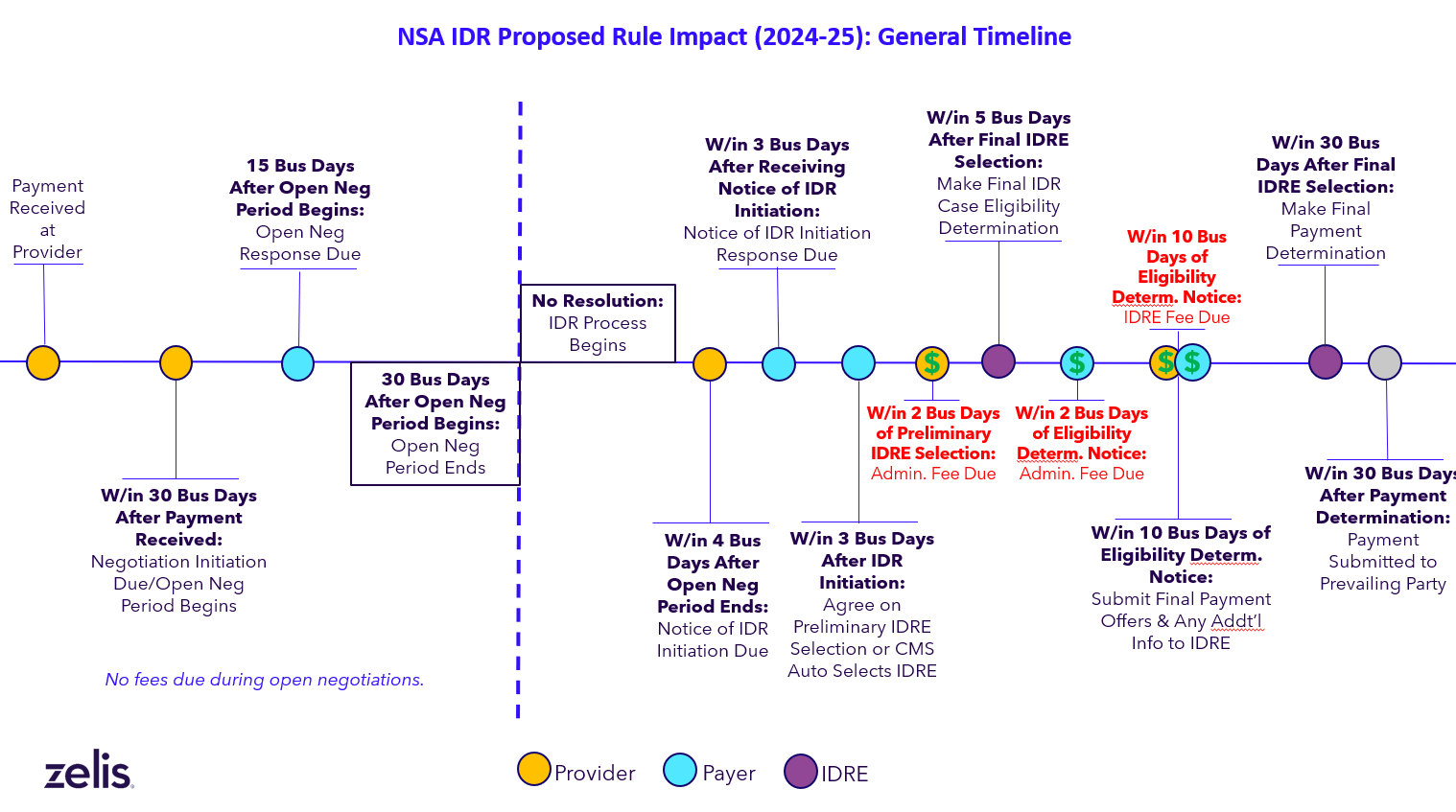

The proposed rule also adjusts the timeframe for collecting the fees. For providers, the administrative fee must be paid within 2 business days of the preliminary selection of the IDRE. Importantly, if the provider does not pay the administrative fee within those two business days, the dispute is closed; i.e., it will not be heard by an IDRE.

For payers, the administrative fee must be paid within 2 business days of the date the provider receives notice that a positive eligibility determination has been made by the IDRE or CMS.

In contrast to the administrative fee, the IDRE fee must be paid by both parties no later than 10 business days after the dispute is determined eligible for the IDR.

The assumption behind these fee adjustments is that, like nearly everything else in the process, collection of payments will be managed within the federal portal. And, under certain circumstances, late payments and unpaid fees will be pursued by CMS as well.

For a better understanding of when fees will be due, check out this timeline:

Several additional fee requirements in the proposed rule include the following:

Administrative fee

- It is CMS’ intention that the total administrative fees for a given year are estimated to be equal to the projected amount of federal expenditures on carrying out the IDR process.

- CMS will reduce the administrative fee for both parties when the highest offer made by either party during open negotiation is less than the administrative fee. In such a case:

- If the dispute is found eligible for the IDR, the fee may be reduced 50% for each party.

- If the dispute is found ineligible for the IDR, the fee may be reduced 50% for the provider and 20% for the payer.

- CMS may also reduce the fee for the payer by 20% if the dispute is found to be ineligible for the IDR process.

IDRE fee

- The proposed rule sets new payment requirements for “batched” items/services and “bundled” items/services.

- These fees are broken down into ranges based on whether they apply to single determinations, batched determinations and number of claim lines within a batched dispute.

Specific dollar amounts and fee ranges associated with each of the two fees can be found in CMS’ December 2023 final rule.

I said this before, but it’s worth repeating: This is a lot to take in and absorb. However, Zelis is committed to helping you through the process.

Our team can work with you to ensure you meet many of these new requirements. We’ll keep you updated as we hear more. In the meantime, learn more about other proposed changes, including a new health plan registry and changes to the open negotiation period.